According to Spotify their “mission is to unlock the potential of human creativity—by giving a million creative artists the opportunity to live off their art and billions of fans the opportunity to enjoy and be inspired by it” (“Spotify Company Info,” 2018). Spotify is certainly living up to part of its goal – as of June of 2018 the company has amassed over 83 million subscribers, 180 million active users, 35 million songs, 2 billion playlists and availability in 65 markets (“Spotify Company Info,” 2018). However, despite this media powerhouse’s popularity it pays artists less than its competition, is not profitable and has been party to multiple lawsuits.

Spotify is a Swedish independent music and media streaming service (including podcasts and short-form video content) owned by Spotify Technology SA, which is headquartered in Stockholm, Sweden (www.reuters.com; “Spotify Company Info”, 2018). Spotify Technology SA, incorporated in 2006, launched its digital streaming service, Spotify, in 2008 (“Company Overview of Spotify Limited,” 2018; “Spotify Company Info”, 2018). Originally a small startup, Spotify, as of March 31, 2018, has 3,813 full-time employees (investors.spotify.com; Safian, 2018). Steered by Daniel Ek, Spotify’s thirty-four year-old Founder and CEO and number three on Billboards 2018 top 100, Spotify has not focused on expansion of its business enterprise, but rather on innovation (Digiacomo, 2018; Safian, 2018).

Spotify’s business structure is built on a ‘freemium’ model (“Company Vitae: Spotify, 2017; Rayna, 2016; Spotify Company Info”). Spotify’s ‘freemium’ model allows users to access media through premium and ad-supported (free) services. For a flat monthly subscription fee (student, standard or family plan), Spotify’s premium services provides customers with commercial free, unlimited and offline streaming (“Music for everyone;” www.reuters.com). Spotify’s ad-supported service allows users to access media for free with limited functionality (www.reuters.com). Spotify, additionally, offers Spotify for Artists, a service which provides Artists with the tools to distribute their music and manage their artists profiles, and access various analytics (www.reuters.com).

In spite of Spotify’s near 30 billion dollar market value evaluation earlier this year, Spotify does not have much as far as traditional assets (Bryant, 2018). In fact, when Spotify listed its shares in NYSE earlier this year it claimed only 90 million dollars of physical valuable assets (Bryant, 2018). However, this does not mean that Spotify is devoid of valuable assets. The true value in Spotify comes from their intangible assets, including, customer relationships, search algorithms, management team, artificial intelligence, and, most importantly, their ability to collect data. (Bryant, 2018; Lane, 2018). Spotify’s data collection allows the company to use their playlist analytics collect details of its user’s listening habits as well as listener demographics including location, gender and age (Witt, 2018; Bryant, 2018).

Spotify obtains revenue from its ad-supported and premium services for consumers, as well as advertisements, and revamped payola (i.e. purchased placement of songs within Spotify’s curated playlists) (Bridge, 2018; www.reuters.com). The bread and butter of Spotify’s revenue is from premium subscribers. However, while Spotify’s ad-supported version does not provide significant revenue, it has proven to be a successful enticement for future subscribers to use their paid services (Lane, 2018; Safian, 2018; investors.spotify.com). This strategy is highlighted by Spotify’s recent move to bundle the streaming services Hulu and Showtime for only $4.99 a month for students (“Spotify Premium for Students,” 2018).

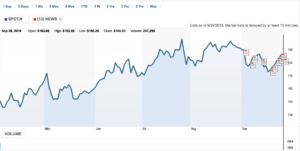

Yet, Spotify’s current revenue model is not working. In 2017, Spotify reported a net loss of 568 million (Gardner, 2018). Although Spotify pays comparatively lower rates per stream than its competitors, around $0.0038 per-stream (Apple Music pays approximately $0.0064 per stream), Spotify spends about 70% of its annual revenue in licensing for these rights (McIntyre, 2017; Gardner, 2018). Spotify’s financial position is further aggravated by its slew of pending lawsuits and settlements with music publishers, including a settlement for 43 million dollars last year (Kreps, 2018). In order to curb this troubling trend, and acquire much needed capital, the company went public in April. 2018, starting at 165.90 USD and closing at 180.83 USD as of September 28, 2018 (www.reuters.com).

Spotify NYSE 2018

Spotify’s position in the media streaming landscape is fragile. Spotify is merely a media streaming company, unlike their biggest competitors (such as, Apple and Amazon). Companies like Apple are able to lower their bottom line to use their media streaming services to expand their digital presence (Safian, 2018; Hough, 2018). Thus, companies like Apple can consume losses as their main source of revenue is not based on their subscription services (Safian, 2018; Hough, 2018).

Moving forward, Spotify’s biggest objective is to expand their presence. Spotify must expand to be profitable, as increased user rates could provide Spotify with more bargaining power to negotiate better rates with music labels (Witt, 2018; “Spotify’s unspoken promise”). Without growth, Spotify is left with unappealing options, such as increasing their rates or removing their free services which could reduce users, and lowering licensing fees which could alienate the record labels (“Spotify’s Path to Success, and Tech Coverage Ideas”).

It has been suggested that Spotify should invest in more original media and work towards vertical integration (i.e. creation, marketing and distribution) (Hu, 2018). However, Ek believes this strategy does not correlate with Spotify’s artist driven directives and, furthermore, he seems to put little stock in vertical integration as a solution (Safian, 2018). Rather, Ek believes innovation, and moving faster than his competition, is key (Safian, 2018)

However, arguably more important, Spotify has a dependent relationship with the ‘Big Three,’ and vertical integration could create increased tension in an already tumultuous relationship. Last year Spotify signed a deal with the ‘Big Three,’ Warner Music Group, Universal Music GroupUniversal and Sony Music Entertainment (Witt, 2018). This armistice is tenuous at best, as the parties have differing goals and competing objectives (Witt, 2018; “Spotify’s unspoken promise”).

Looking to the future, it is likely Spotify will continue to use methods to gain premium subscribers, diversify their media, and potentially move towards Spotify original content. Whether or not this will be proven successful is unknown.

Bridge, Mark. Musicians ‘paying thousands for place on Spotify playlists’.” Times [London, England] 17 Mar. 2018: 19. Business Insights: Essentials. Retrieved from http://bi.galegroup.com.libezproxy2.syr.edu/essentials/article/GALE%7CA531296885? u=nysl_ce_syr.

Bryant, C. (2018, April 6). Spotify’s $26 Billion Value Is Hard to Put Your Finger On. Retrieved from https://www.bloomberg.com/gadfly/articles/2018-04-09/spotify-s-26-billion-value-is-hard-to-put-your-finger-on.

Company Overview of Spotify Limited. (2018, September 28). Retrieved from https://www.bloomberg.com/research/stocks/private/snapshot.asp?privcapId=49444968.

Company vitae: Spotify. (2017). Management Today, 12. Retrieved from https://search-proquest-com.libezproxy2.syr.edu/docview/1905634177?accountid=14214.

Digiacomo, F. (2018). THE POWER 100 2018. Billboard, 130(3), 49-52,54,56,58,60,68-70,72,74,76,78,80,82,84,86-88,90-92,94-96,98,100. Retrieved from https://search-proquest-com.libezproxy2.syr.edu/docview/2073441918?accountid=14214.

Gardner, E. (2018). Can Spotify Pull Off Music’s Power Move? Hollywood Reporter, 424, 44. Retrieved from https://search-proquest-com.libezproxy2.syr.edu/docview/2001354876?accountid=14214.

Hough, J. (2018). Watch spotify’s IPO- and buy this instead. Barron’s, 98(3), 15. Retrieved from https://search-proquest-com.libezproxy2.syr.edu/docview/1987647091?accountid=14214.

Hu, C. (2018, August 09). Five Takeaways From Spotify CEO Daniel Ek’s Interview With Fast Company. Retrieved from https://www.billboard.com/articles/business/8469196/five-takeaways-spotify-ceo-daniel-ek-interview-with-fast-company.

Kreps, D. (2018, June 25). Wixen’s $1.6 Billion Spotify Lawsuit: What You Need to Know. Retrieved from https://www.rollingstone.com/music/music-news/wixens-1-6-billion-spotify-lawsuit-what-you-need-to-know-202532/.

Lane, C. (2018). Spotify goes public valued at nearly $30 billion – but its future isn’t guaranteed. Washington: NPR. Retrieved from https://search-proquest-com.libezproxy2.syr.edu/docview/2021129975?accountid=14214.

McIntyre, H. (2017, July 27). What Do The Major Streaming Services Pay Per Stream? Retrieved from https://www.forbes.com/sites/hughmcintyre/2017/07/27/what-do-the-major-streaming-services-pay-per-stream/#2393de9c448c.

Music for everyone. (n.d.). Retrieved from https://www.spotify.com/us/premium/?checkout=false.

Rayna, T., & Striukova, L. (2016). 360° business model innovation: Toward an integrated view of business model innovation. Research Technology Management, 59(3), 21-28. doi:http://dx.doi.org.libezproxy2.syr.edu/10.1080/08956308.2016.1161401.

Safian, R. (2018, August 30). Exclusive: Spotify CEO Daniel Ek on Apple, Facebook, Netflix–and the future. Retrieved September 20, 2018, from https://www.fastcompany.com/90213545/exclusive-spotify-ceo-daniel-ek-on-apple-facebook-netflix-and-the-future-of-music.

Spotify – Company Info. (n.d.). Retrieved from https://newsroom.spotify.com/companyinfo/.

Spotify – Media Kit. (n.d.). Retrieved from https://newsroom.spotify.com/mediakit/.

“Spotify’s Path to Success, and Tech Coverage Ideas.” New York Times 5 Mar. 2018: B2(L). Business Insights: Essentials. Web. 23 Sept. 2018. Retrieved from http://bi.galegroup.com.libezproxy2.syr.edu/essentials/article/GALE|A529829493/0829240c6ace311d82c0ad8488263c87?u=nysl_ce_syr.

Spotify Technology SA (SPOT.N) Chart. (n.d.). Retrieved from https://www.reuters.com/finance/stocks/chart/SPOT.N.

Spotify Technology S.A. Announces Financial Results for First Quarter 2018. (n.d.). Retrieved from https://investors.spotify.com/financials/press-release-details/2018/Spotify-Technology-SA-Announces-Financial-Results-for-First-Quarter-2018/default.aspx

Spotify’s unspoken promise: A different business. (2018, Mar 31). Dow Jones Institutional News Retrieved from https://search-proquest-com.libezproxy2.syr.edu/docview/2020231709?accountid=14214.

Witt, S. (2018, April 04). Spotify Is, For Now, The World’s Most Valuable Music Company. Retrieved from https://www.npr.org/sections/therecord/2018/04/04/599385111/spotify-is-for-now-the-worlds-most-valuable-music-company.

(2018, August 29): Spotify Premium for Students: Now with Hulu and SHOWTIME. Retrieved from https://newsroom.spotify.com/2018-08-29/spotify-premium-for-students-now-with-hulu-and-showtime/.