The Telecommunications Act of 1996 was a game changer in the broadcasting industry. It removed restrictions on ownership which transformed the industry from an oligopoly to a more competitive one (Economides, 1998). Lewis W. Dickey Jr. and Richard Weening founded Cumulus Media in Milwaukee, Wisconsin as a result of this Act. Cumulus Media went public in 1998 and purchased 167 broadcast stations (Zoll, 2015). Their goal was to acquire stations in small to mid-size markets, mostly in the Midwest, Southwest, Southeast, and Northeast regions. They eventually expanded to the West Coast as well. By the end of 1999, Cumulus Media had 299 radio stations owned or pending ownership, making them the second largest company. They reported $180 million in revenue but had a loss of $10.1 million that year. Financial and legal challenges in 2000 led them to move their headquarters to Atlanta, Georgia, left with 225 stations, and a lot of debt (Business Insights: Essentials, 2001).

As of 2016, Cumulus Media had a revenue of $1.1 billion, but were still operating on a loss (Plunkett Research, 2018). In 2017, they had the second largest revenue in comparison to other radio broadcasting companies but were still $1 billion in debt. They filed for Chapter 11 bankruptcy but were optimistic about the restructuring process (Dow Jones Institutional News, 2017). In June 2018, the current President and CEO of Cumulus Media, Mary Berner, announced that they had completed the financial restructuring process and are confident about its financial foundation moving forward (CNBC, 2018).

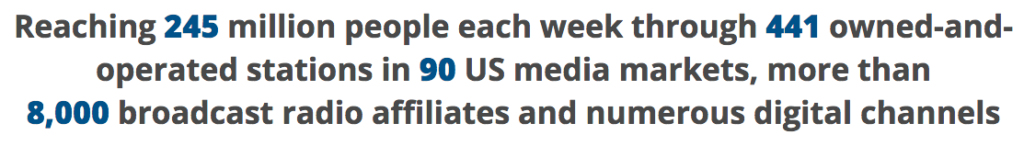

Cumulus Media consists of the Cumulus Radio Station Group and Westwood One. Cumulus owns and operates 441 broadcasting stations (Cumulusmedia.com). Westwood One has an audio network of 8,000 broadcast stations and offers programming in music, entertainment, news, talk radio, along with providing services and imaging. 24/7 formats are also offered to meet the needs of each local market. They are the exclusive broadcasting partners of popular brands like the NFL, NCAA, Grammy’s, Billboard Music Awards, and more. They also have good deals with on-air personalities and networks like CBS and NBC Sports radio are featured on Westwood One (Westwoodone.com).

In addition, Cumulus Media owns “NASH”, a brand that provides country music and lifestyle content (Cumulusmedia.com). They own other tangible assets such as land, broadcasting equipment, computers and capitalized software, furniture, buildings, broadcasting licenses, intangible assets like reputation, image, and relationships, and goodwill. The total worth of the assets as of June 2018 was around $1.81 million (MergentOnline).

Cumulus Media’s business model is to provide programming through its broadcast stations and digital channels, and generate revenue through advertisements, and licensing. They reach 245 million people in 90 media markets in America (Cumulusmedia.com). The primary categories of advertisers are automotive dealers, amusement and recreation, banking and mortgage, healthcare, arts and entertainment, food and beverage, telecommunications, and furniture (MergentOnline).

Revenue from the Radio Station Group comes from the sale of broadcast time to local, regional, and national advertisers, while revenue from Westwood One comes from network advertising (CNBC, 2018). National sales for the radio stations are made by a firm specializing in it while regional sales are made by the local sales staff and market managers. Advertising rates are based on the station’s audience and demographic groups, supply and demand for advertising time, and brand loyalty. Rates and programming are adjusted according to ratings. Advertising revenues vary by the quarter. The second and fourth quarters usually generate the highest revenue while the first quarter generates the lowest. It may fluctuate according to current events like political advertisements or advertisements from special interest groups. Apart from network, broadcast, and political advertising, Cumulus Media also generates revenue through digital advertising. This comes from the sale of advertising and promotional opportunities across their streaming audio network, digital commerce platform, websites and mobile applications (MergentOnline).

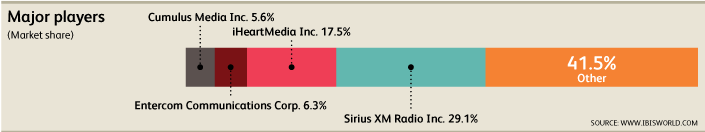

The direct competitors are “iHeartMedia Inc” with 17.5% of the market share and “Entercom Communications Corp” with 6.3% while Cumulus Media has 5.6%. Their secondary competitor is “Sirius XM Radio Inc” with 29.1% of the market share (IBISWorld, 2018). Other secondary competitors include “Spotify”, “Apple Music” and “Pandora” as audio streaming services have been growing. Satellite radio has been widely successful which led to the domination and growth of Sirius XM. Steele and Prang (2018) reported that Sirius XM is now the largest audio entertainment company after acquiring Pandora. This will drastically increase the competition for Cumulus Media. Their main suppliers are advertising agencies who buy air time for their clients, internet service providers who provide satellite services for radio stations to broadcast across a geographic area, record labels via licensing deals, and news syndicates.

In August 2018, Cumulus Media announced a multi-year partnership with Total Traffic and Weather Network (TTWN), a subsidiary of iHeartMedia. Cumulus was already using TTWN for weather information but now they will also be its exclusive provider of traffic reports and data. This partnership gives Cumulus a wider reach as TTWN has over 196 million listeners (Insideradio, 2018).

In the same month, Cumulus Media announced another partnership. Westwood One had an agreement with “TuneIn”, a popular live audio streaming service. Cumulus Media decided to expand that agreement into a multi-year partnership. TuneIn has 75 million monthly users, which will also broaden the reach for Cumulus (Tunein.com, 2018). According to IBISWorld (2018), the radio industry will face increasing competition from music streaming and podcasts over the next five years. These partnerships could be a smart move if that is the case.

Mary Berner is optimistic about the future of Cumulus Media. She said they have unique growth initiatives that will help them take on the industry. They are focused on optimizing their assets through mergers and acquisitions. She mentioned the growth of streamed listening and podcasts, and that they are looking for ways to take advantage of that (Business Insights: Essentials, 2018). They seem confident and have emerged strong from the bankruptcy even with all the consolidation and new trends in the industry.

References

CNBC. (2018, June 04). CUMULUS MEDIA Successfully Completes Financial Restructuring. Retrieved from https://www.cnbc.com/2018/06/04/globe-newswire-cumulus-media-successfully-completes-financial-restructuring.html

CNBC. (2018, March 28). Cumulus Reports Operating Results for Fourth Quarter and Full Year 2017. Retrieved from https://www.cnbc.com/2018/03/28/globe-newswire-cumulus-reports-operating-results-for-fourth-quarter-and-full-year-2017.html

Cumulus Inks Traffic Deal With iHeart’s Total Traffic. (2018, August 21). Retrieved from http://www.insideradio.com/free/cumulus-inks-traffic-deal-with-iheart-s-total-traffic/article_e507080a-a50d-11e8-9411-3f6c67a25f41.html

Cumulus media files for bankruptcy. (2017, Nov 30). Dow Jones Institutional News. Retrieved from https://search-proquest-com.libezproxy2.syr.edu/docview/1970486515?accountid=14214

Cumulus Media Inc. (2018, January 9). Plunkett Corporate Benchmarking Reports; Houston. Retrieved from https://search-proquest-com.libezproxy2.syr.edu/docview/2015529918?pq-origsite=summon&accountid=14214

Cumulus Media Inc. (n.d). Mergent Online. Retrieved from http://www.mergentonline.com.libezproxy2.syr.edu/companydetail.php?pagetype=synopsis&compnumber=94986

Cumulus Media Inc. (n.d). Mergent Online. Retrieved from http://www.mergentonline.com.libezproxy2.syr.edu/companydetail.php?pagetype=business&compnumber=94986

Cumulus Media Inc. (2017, Dec 31). Annual report on Form 10-K. Mergent Online. Retrieved from http://www.mergentonline.com.libezproxy2.syr.edu/documents.php?compnumber=94986

Fair Disclosure Wire. (2018, August 20). Q2 2018 Cumulus Media Inc Earnings Call – Final. Business Insights: Essentials. Retrieved from http://bi.galegroup.com.libezproxy2.syr.edu/essentials/article/GALE|A554622618?u=nysl_ce_syr&sid=summon

Home. (n.d.). Retrieved from https://www.cumulusmedia.com/

International Directory of Company Histories. (2001). Cumulus Media Inc. Business Insights: Essentials. Retrieved from http://bi.galegroup.com.libezproxy2.syr.edu/essentials/article/GALE|I2501305970?u=nysl_ce_syr&sid=summon

McGinley, D. (2018, May). Radio Broadcasting in the US. IBISWorld Industry Report 51511 M. Retrieved from https://clients1-ibisworld-com.libezproxy2.syr.edu/reports/us/industry/majorcompanies.aspx?entid=1258

McGinley, D. (2018, May). Radio Broadcasting in the US. IBISWorld Industry Report 51511 M. Retrieved from https://clients1-ibisworld-com.libezproxy2.syr.edu/reports/us/industry/industryoutlook.aspx?entid=1258

Programming. (n.d.). Retrieved from https://www.westwoodone.com/PROGRAMMING/

Steele, A., & Prang, A. (2018, September 24). Sirius XM to Buy Pandora in Bet on Streaming Music. Retrieved from https://www.wsj.com/articles/sirius-xm-is-buying-pandora-1537788241

The Telecommunications Act of 1996 and its Impact*. (n.d.). Retrieved from http://raven.stern.nyu.edu/networks/telco96.html

TuneIn and CUMULUS MEDIA Announce Multi-Year Expansion Deal. (n.d.). Retrieved from https://tunein.com/press-release/tunein-and-cumulus-media-announce-multi-year-expansion-deal/

Zoll, B. Y. (2015). Cumulus Media, Inc. Strategic Analysis. Johnson & Wales University. Retrieved from https://scholarsarchive.jwu.edu/cgi/viewcontent.cgi?article=1038&context=mba_student.